Preparing for a secure retirement is a long-term financial goal that requires careful planning and strategic savings and investment strategies. In this article, we will explore the key considerations and approaches to help you secure your financial future during retirement.

Setting Retirement Goals

Before diving into savings and investment strategies, it’s essential to define your retirement goals:

- Retirement Lifestyle: Determine the lifestyle you envision during retirement. Will it be modest, comfortable, or luxurious? Your goals will influence your savings target.

- Retirement Age: Decide at what age you plan to retire. An early retirement will require more savings, while a later retirement can provide additional time to save.

- Financial Security: Assess your desired level of financial security during retirement, including factors like healthcare and travel expenses.

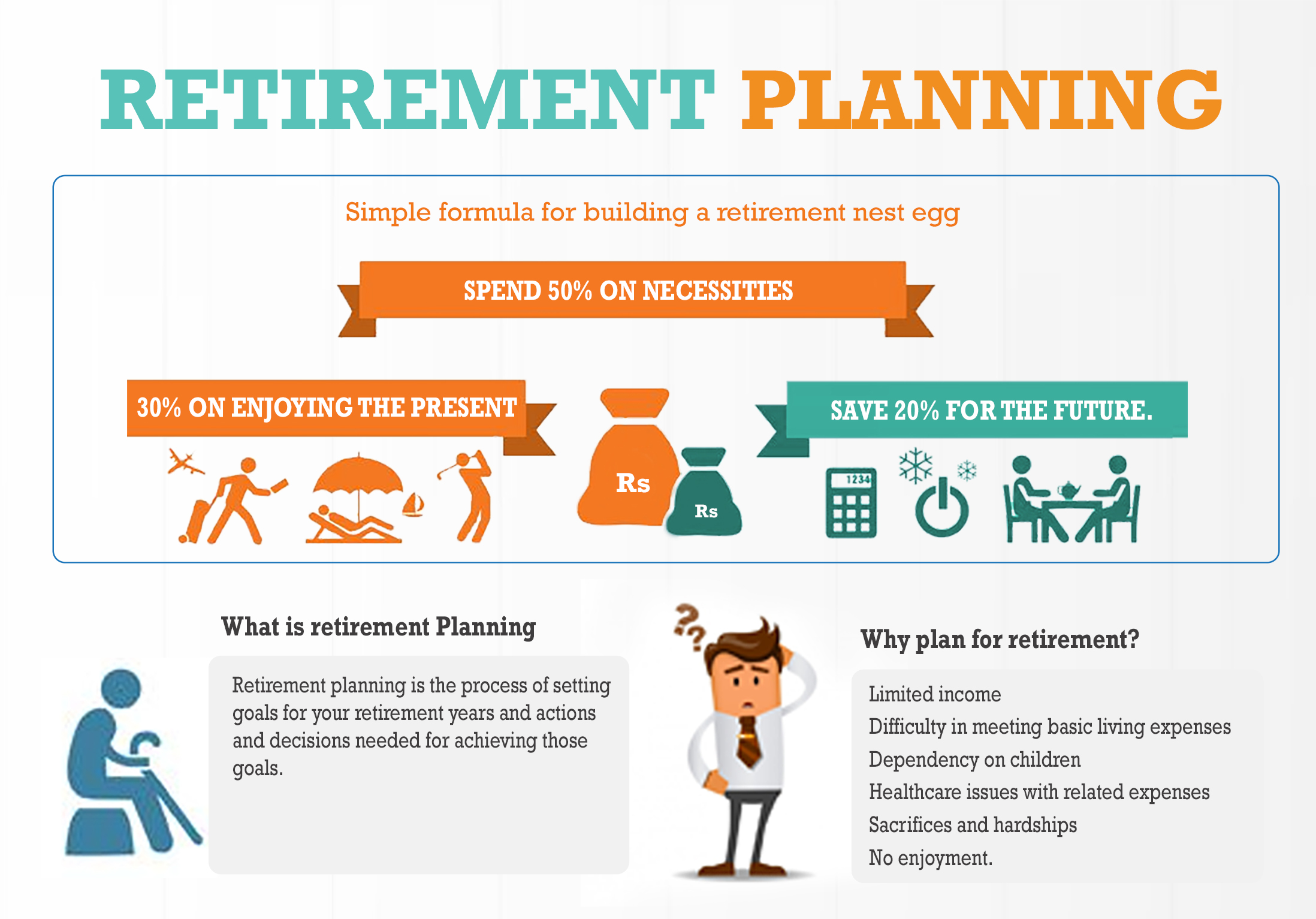

Savings Strategies

Effective savings strategies are fundamental to building a solid retirement foundation:

- Start Early: The earlier you start saving for retirement, the more time your money has to grow. Even small contributions can accumulate significantly over time.

- Maximize Employer Benefits: If your employer offers retirement benefits like a 401(k), take full advantage of them. Contribute enough to maximize any employer match, as this is essentially free money.

- Individual Retirement Accounts (IRAs): Consider opening an IRA, such as a Traditional or Roth IRA, to benefit from tax advantages and additional retirement savings.

- Automate Savings: Set up automatic contributions to your retirement accounts. This ensures consistent savings and reduces the temptation to spend the money elsewhere.

- Increase Savings with Raises: Whenever you receive a salary increase, consider increasing your retirement contributions rather than immediately increasing your spending.

Investment Strategies

Smart investment strategies can help your retirement savings grow over time:

- Diversification: Diversify your investment portfolio by spreading your money across various asset classes, reducing risk and increasing the potential for returns.

- Asset Allocation: Determine the right mix of stocks, bonds, and other assets based on your risk tolerance and time horizon. Adjust your allocation as you approach retirement.

- Regular Contributions: Continue making regular contributions to your retirement accounts. Consistency is key to long-term investment success.

- Consider Professional Guidance: If you’re unsure about your investment choices, consider consulting with a financial advisor or planner who can help create a tailored investment strategy.

- Stay Informed: Keep yourself informed about the performance of your investments and consider periodic rebalancing of your portfolio.

Additional Considerations

- Healthcare Costs: Plan for potential healthcare costs during retirement. Medicare may not cover all expenses, so having supplemental insurance is important.

- Long-Term Care: Consider the possibility of long-term care needs during retirement and explore options for coverage.

- Social Security: Understand how Social Security benefits work and when it’s best to start claiming them.

- Legacy Planning: If you want to leave a legacy, consider how your retirement savings will factor into your estate planning.

Conclusion

Securing a financially stable retirement requires a combination of disciplined savings and strategic investments. By setting clear retirement goals, consistently saving, and making informed investment decisions, you can work towards a retirement that aligns with your vision of financial security and peace of mind. Start early, stay committed to your savings and investment plans, and regularly reassess your progress to make any necessary adjustments.